The phrase “net worth of Bo Derek 2025” refers to the estimated total value of Bo Derek’s assets minus her liabilities in the year 2025. This figure would encompass the combined value of her various holdings, including real estate, investments, and other personal property. Calculating net worth involves assessing the current market value of assets and deducting outstanding debts. Projecting net worth into the future, as in the case of 2025, requires speculation and consideration of potential market fluctuations and changes in personal finances.

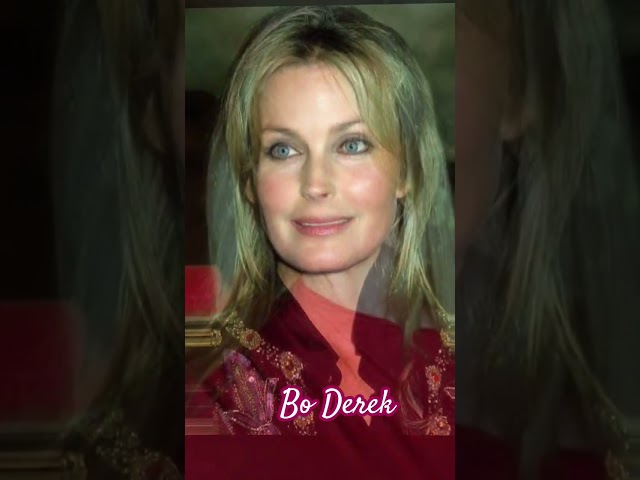

Net Worth of Bo Derek 2025

Estimating the net worth of any individual, including Bo Derek, for a future date involves considerable uncertainty. Predicting future financial performance requires analyzing current trends in income, expenses, and investments. Furthermore, external factors such as market conditions and unforeseen events can significantly impact an individual’s financial standing. Therefore, any projection of Bo Derek’s net worth in 2025 should be considered speculative.

Public figures like Bo Derek do not typically disclose detailed financial information. This makes accurate net worth estimations challenging. While some estimates may be available from various sources, these figures should be treated with caution. They often rely on publicly available information and may not reflect the complete picture of an individual’s financial situation.

Bo Derek’s career has spanned several decades, encompassing acting, modeling, and producing. Her income streams likely vary over time, influenced by project involvement and other business ventures. Considering these fluctuating income sources is crucial when attempting to project future net worth.

Real estate holdings can constitute a significant portion of an individual’s net worth. If Bo Derek owns properties, their value could appreciate or depreciate over time, impacting her overall net worth. Changes in the real estate market can be unpredictable and should be factored into any future projections.

Investment portfolios, including stocks, bonds, and other assets, can also play a significant role in net worth. Market volatility can influence the value of these investments, making future projections challenging. Diversification and investment strategies can influence how these assets perform over time.

Personal expenditures and lifestyle choices also contribute to the overall picture of net worth. While it is difficult to predict future spending habits, these factors can influence how an individual’s net worth changes over time. Major life events and personal decisions can also impact financial standing.

It’s important to recognize that any estimate of Bo Derek’s net worth in 2025 remains purely speculative. Without access to private financial information, projections are based on incomplete data and assumptions. Therefore, any figures presented should be considered estimates rather than definitive statements.

Focusing on understanding the factors that influence net worth, rather than fixating on a specific number, offers a more insightful approach. Analyzing career trajectory, investment strategies, and market trends provides a broader perspective on financial dynamics.

Important Points to Consider

-

Public Information Limitations:

Information regarding celebrity net worth is often based on estimates and publicly available data, which may not be entirely accurate or comprehensive. Celebrities rarely disclose their complete financial details, making precise calculations difficult. Furthermore, estimates can vary widely depending on the source and methodology used. It’s essential to consider these limitations when evaluating net worth figures.

-

Market Volatility:

Investment portfolios are subject to market fluctuations, which can significantly impact net worth. Stock market performance, interest rates, and economic conditions can all influence the value of investments. Therefore, projections of future net worth must consider the potential for market volatility and its impact on asset values.

-

Real Estate Fluctuations:

Real estate values can appreciate or depreciate over time, influenced by local market conditions and broader economic trends. Property taxes and maintenance costs can also affect the overall value of real estate holdings. These fluctuations can significantly impact net worth, especially for individuals with substantial real estate assets.

-

Private Business Ventures:

If Bo Derek is involved in private business ventures, the success or failure of these enterprises can significantly impact her net worth. Business valuations can be complex and depend on various factors, including revenue, profitability, and market conditions. The performance of these ventures adds another layer of complexity to net worth projections.

-

Liabilities and Debts:

Outstanding debts, such as mortgages, loans, and other liabilities, reduce net worth. The amount and type of debt can significantly influence an individual’s financial standing. Accurate net worth calculations require considering all liabilities and their impact on overall assets.

-

Currency and Inflation:

Net worth figures are typically expressed in a specific currency, and inflation can erode the purchasing power of that currency over time. When considering future net worth projections, it’s crucial to account for potential inflation and its impact on the real value of assets. Currency fluctuations can also influence net worth for individuals with international holdings.

-

Future Earnings Potential:

Projecting future earnings can be challenging, especially for individuals in entertainment careers. Future acting roles, endorsements, and other income sources can influence net worth. However, predicting these opportunities and their associated income is inherently speculative.

-

Personal Spending and Lifestyle:

Personal spending habits and lifestyle choices can significantly impact net worth over time. Major purchases, philanthropic contributions, and other expenditures can influence how an individual’s financial resources evolve. These factors are difficult to predict and vary based on individual circumstances.

Tips for Understanding Net Worth

-

Focus on Trends:

Instead of focusing on a specific net worth number, consider the overall trends in an individual’s financial situation. Analyzing career progression, investment strategies, and spending patterns can provide a more insightful understanding of their financial health. This approach offers a broader perspective than a single, potentially inaccurate, net worth figure.

-

Consider Diversification:

Diversification of investments across different asset classes can help mitigate risk and potentially enhance long-term returns. A diversified portfolio can better withstand market fluctuations and offer greater stability. Understanding the importance of diversification is crucial for comprehending how investment strategies impact net worth.

-

Consult Financial Professionals:

For personalized financial advice, consulting a qualified financial advisor is recommended. They can provide tailored guidance based on individual circumstances and financial goals. Professional advice can offer valuable insights into managing finances and building long-term wealth.

-

Research and Due Diligence:

Before making any investment decisions, conducting thorough research and due diligence is essential. Understanding the risks and potential rewards associated with different investments is crucial for informed decision-making. This process helps protect against potential losses and maximizes the potential for financial growth.

Financial planning involves setting clear financial goals and developing strategies to achieve them. This process considers various aspects of personal finance, including budgeting, saving, investing, and retirement planning. A well-defined financial plan can help individuals manage their resources effectively and work towards their desired financial outcomes.

Understanding the difference between assets and liabilities is fundamental to grasping the concept of net worth. Assets represent things of value that an individual owns, while liabilities represent outstanding debts or obligations. The difference between these two figures determines an individual’s net worth.

Managing debt effectively is crucial for maintaining a healthy financial position. High levels of debt can negatively impact net worth and hinder financial progress. Developing strategies to reduce debt and manage it responsibly is essential for long-term financial well-being.

Building an emergency fund provides a financial safety net for unexpected expenses. Having accessible funds for emergencies can prevent individuals from accumulating additional debt or facing financial hardship. A robust emergency fund is a key component of sound financial planning.

Investing wisely involves understanding different investment options and making informed decisions based on individual risk tolerance and financial goals. Diversification, long-term planning, and regular review of investments are crucial for maximizing returns and minimizing risks.

Retirement planning involves setting aside funds for retirement and managing those funds effectively to ensure a comfortable retirement. Understanding different retirement savings plans and developing a long-term retirement strategy are essential for securing future financial stability.

Estate planning involves making arrangements for the distribution of assets after death. This process includes creating wills, trusts, and other legal documents to ensure that assets are distributed according to an individual’s wishes. Proper estate planning can help minimize complications and ensure a smooth transfer of assets.

Seeking professional financial advice can provide valuable insights and guidance for managing finances effectively. Financial advisors can offer personalized recommendations based on individual circumstances and financial goals, helping individuals make informed decisions and achieve their financial objectives.

Frequently Asked Questions

John: How is net worth calculated?

Prof. Design: Net worth is calculated by subtracting total liabilities from total assets. Assets include items like real estate, investments, and personal property. Liabilities include debts like mortgages, loans, and credit card balances.

Sarah: Why is it difficult to determine the exact net worth of celebrities?

Dr. Creative: Celebrities often hold assets in various forms, including private businesses and investments, which are not always publicly disclosed. Furthermore, fluctuating market conditions can impact the value of these assets, making precise calculations challenging.

Ali: What factors can influence net worth over time?

Prof. Design: Several factors can influence net worth, including investment performance, real estate market fluctuations, business ventures, inheritance, spending habits, and economic conditions. These factors can contribute to both increases and decreases in net worth.

Mary: Are online estimates of celebrity net worth reliable?

Dr. Creative: Online estimates should be viewed with caution, as they often rely on publicly available information and may not represent a complete picture of an individual’s financial situation. These estimates can vary widely and should be considered approximations rather than definitive figures.

David: Why is it important to understand the concept of net worth?

Prof. Design: Understanding net worth provides a snapshot of an individual’s overall financial health. It helps track financial progress, identify areas for improvement, and make informed decisions about spending, saving, and investing.

Youtube Video: